Why states must rely on solar, wind, and batteries to hit their 100% clean electricity goals

Meeting federal and state policy goals requires rapidly building solar PV, wind turbine, and battery facilities. There are no other cost-effective solutions in the next decade.

Source: Canva

The Biden administration wants the U.S. to be powered with 100% carbon-free electricity by 2035. Additionally, 22 U.S. states (plus D.C. and Puerto Rico) have passed laws or executive orders to reach 100% clean energy between 2030 and 2050. The 25 U.S. Climate Alliance governors and the Clean Energy States Alliance (CESA) support the states' plans. These are bold goals!

Why the urgency to think and act big? President Biden and the governors know electric utilities must slash CO2 emissions to limit life-threatening and economically disastrous rising temperatures.

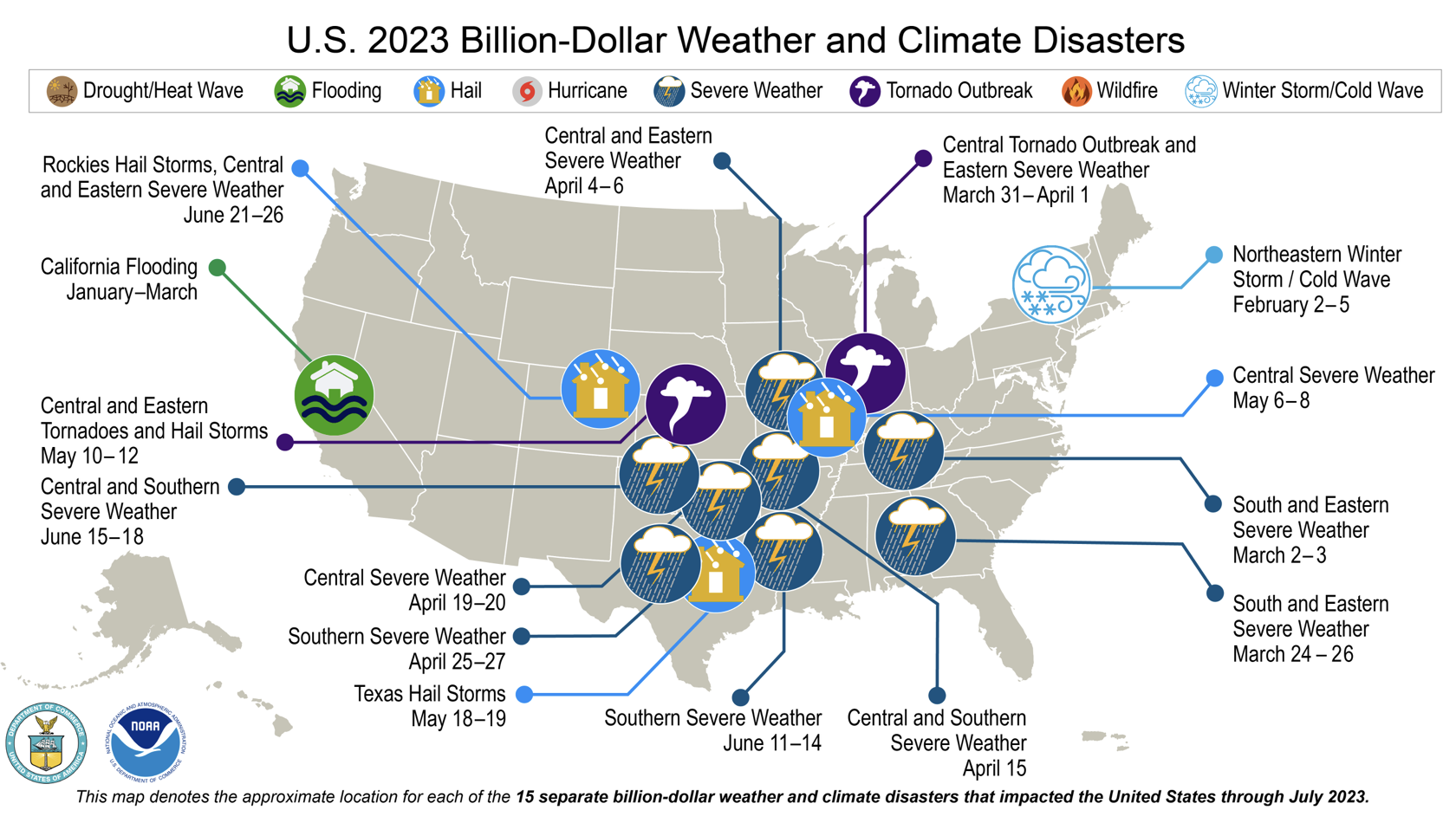

Cable news is filled weekly with climate catastrophe videos. The southern states have seen unbearably hot temperatures risking the lives of outside workers. Wildfire smoke from the western states and Canada has polluted our skies with dense smoke and particulates. Hurricanes, hail storms, and other extreme weather events have already cost more than one-billion dollars for each event. To borrow the title from Maine’s Climate Plan, “Maine [and the U.S.] Won’t Wait.”

Yet, the U.S. has far to go to meet clean energy goals.

Generating 100% clean electricity is a physical infrastructure challenge. We are not building clean energy power plants and transmission lines fast enough to meet our goals.

Most cars still burn gasoline, most homes heat with oil or natural gas, and utilities still generate their power with coal, gas, and oil. In 2022 non-fossil-fuel energy accounted for only 21% of the U.S. energy supplies, with older nuclear, biofuels, and hydro technologies dominating the mix.

Source: Energy Information Administration “Today on Energy” June 29, 2023

And, states’ energy use is far from meeting their targets.

Most states have barely begun the transition (see States Clean Energy Efforts Are Lagging).

What about the CESA states that have committed to 100% clean energy? In 2020 the 22 CESA states received only 16% of their energy from clean sources (excludes biofuels and biomass). Over half of the CESA states depend on old nuclear, hydroelectricity, and geothermal power plants.

Cleantech Adoption with 2020 data from the U.S. Energy Administration.

Why nuclear, hydro, and geothermal technologies will not bring us 100% clean energy in the time we need.

Moving the economy to clean electricity in the next one to two decades will not be achieved with new nuclear, hydro, and geothermal plants. They are not suitable for fast deployment. Why?

Large nuclear plants cost billions and take decades to build. A seven-year delay forced Georgia Power’s units 3 and 4 Vogtle power plants over budget by $17 billion for a total cost of $31 billion. In 2017, Westinghouse, the contractor responsible for building the units, filed for bankruptcy because of cost overruns. No other utility will now take on the risk of building a new, large nuclear power plant.

The other significant risk of nuclear power is storing and safe disposition of nuclear waste. No politically viable solution exists, thus limiting siting and acceptance of these facilities.Small modular reactors (SMR) are planned but not yet built. Technology news for small nuclear power plants is promising. For example, GE Hitachi Nuclear Energy plans to build two of its BWRX-300 SMR plants in North America, one for Ontario Power Generation (OPG) and the other for Tennessee Valley Authority (TVA). The GE designs do not require High-Assay Low-Enriched Uranium(HALEU) fuel, which means they can operate with available fuels. Regardless, these plants' siting, permitting, construction, and testing will take years.

Another company, X-Energy, plans to build an SMR at a Dow manufacturing site using $1.2 billion from the Advanced Reactor Demonstration Program (ARDP) with the Department of Energy. This project will test X-Energy’s design feasibility, but the financing is not repeatable. This demonstration project is not readily scalable at this time.

A third project between NuScale and the Utah Associated Municipal Power Systems has announced that their proposed project increased from $5.3 billion to $9.3 billion, with power prices rising 53%, from $58/MWh to $89/MWh. The cost overruns may delay the project construction. UtilityDive states, “The U.S. Department of Energy has provided $1.4 billion of funding to the SMR project, and the recently enacted Inflation Reduction Act offers an additional subsidy estimated at $30/MWh. Without the billions in taxpayer backing, the price of the power from the NuScale SMR would be substantially higher than $120/MWh.” Again, this project is not repeatable at this time.

Further, SMR projects are delayed due to the unavailability of HALEU in 20 SMR designs. According to the U.S. Office of Nuclear Energy, HALEU is enriched from 5% to 20% uranium. This fuel was to be provided by Russia before the Ukraine war. The industry needs a new source. To move forward, the Nuclear Regulatory Agency has approved a demonstration manufacturing facility by Centrus in Piketon, Ohio. The project construction has yet to start.Fusion atomic reactors are still science experiments and not yet ready. Seven companies are testing competing fusion designs. While scientifically exciting, these designs will not provide zero-emission electricity in the next two decades.

Internationally, 35 nations have contributed $22 billion to the International Thermonuclear Experimental Reactor (ITER) in Saint-Paul-les-Durance, France. Despite the money and talent thrown at this project, the first test date has had repeated delays, with the start date still uncertain.

Commonwealth Fusion, a private company in Massachusetts, has spent more than $2 billion to accelerate fusion commercialization. They hope to generate power within this decade.New, large-scale hydropower dams will not get built. Permitting and siting of new dams will not happen anytime soon. No community will readily approve flooding a new large swath of land.

As an alternative, hydropower advocates seek funding to rebuild and repower existing dams (see The Hydropower Vision Roadmap: A Pathway Forward by the Department of Energy). The Bipartisan Infrastructure Law (BIL) provides $754 million toward improving hydroelectric dam efficiency, grid resilience, and safety improvements, primarily for existing or refurbished dams.

Pumped storage hydro (PSH) provides another alternative. Today, “the United States has 43 existing PSH projects with over 22,800 megawatts of storage capacity, representing more than 94% of all installed energy storage capacity.” However, despite the interest to build more PSH facilities, the siting, permitting, and interconnecting them to the grid remains a complex, time-consuming challenge.Utility-scale geothermal systems to produce electricity are limited. Geothermal electricity plants have been installed since the 1960s, with one-half of the systems installed in the 1980s. Only 2.5 gigawatts of electricity (0.2% of U.S. energy use) is supplied by geothermal sources, mainly in California and Nevada.

Fervo Energy has an alternative plan for geothermal water wells. Instead of dams, they plan to store excess wind and solar-generated electricity as heat in underground wells for later use to convert back to electricity. While promising, this storage technology is still in the experimental and test stage.

Solar, wind, and batteries are the only viable solution.

Solar, wind, and batteries are winning the deployment race against all other technologies. And they can be added across all states, bringing jobs and economic development to every community, not just fossil-fuel-producing regions. As an added benefit, these clean energy technologies are leading to the retirement of old fossil-fuel plants.

Source: Vehicle Technologies Office, “Fact of the Week #1304, August 21, 2023

Combining all three technologies provides all-day power.

Solar, wind, and batteries complement each other — increasing grid reliability. How?

Hybrid solar plus battery moves excess daytime power to the evening. In California, for instance, the midday cost of electricity can be near or below $0/kWh because of the abundant supply of solar energy. This inexpensive power is saved in batteries and sold at a higher price after sunset.

The trend graph below shows how this works. The darker yellow line represents solar PV electricity generated during daylight hours. The lighter yellow line shows batteries charging with excess solar power during the day and then discharging electricity to the grid in the evening.

Source: CAISO, Supply Trends Outlook

Wind generates more of its electricity at night. Analyzing wind patterns across all regions shows that wind power is highest at night when solar panels are not operating. As a representative example, on August 1, 2023, wind generators in California produced up to 4,000 MW when the sun was not shining (compare the blue wind line to the yellow solar line). Wind generation is the perfect complement to solar.

Source: CAISO Renewables Trend

Zero-emission electricity produces the least cost power.

EIA estimates the levelized cost of competing electricity generation and storage options in its annual forecast analysis. The Levelized cost of electricity (LCOE) represents the estimated cost for engineering, building, financing, owning, and operating a generator and battery system.

In EIA’s most recent study, solar PV, hybrid solar PV with batteries, and onshore wind have the lowest LCOE. For example, the LCOE of solar PV is :

One-half of the cost of the most efficient gas-fired combined-cycle power plants,

One-third of the cost of advanced nuclear facilities and

One-quarter of the cost of new coal-fired plants.

On a cost basis, zero-carbon energy sources win.

Source: Energy Information Administration, “Levelized Costs of New Generation Resources in the Annual Energy Outlook 2023”

Off-shore wind equipment and operation cost estimates are high, but U.S. experience is just starting. The U.S. engineering, construction, and project management expertise will develop as companies build projects. As with solar PV and battery technologies, experience leads to rapidly declining costs.

The path forward is clear.

To achieve their goals, governors, legislators, and regulators must urgently support wind, solar, and battery installations in their regions. Otherwise, we will not reach 100% clean electricity for our economy within the next one to two decades.